🎅 Merry Christmas, community of DTC Moguls!

This week in DTC Dispatch:

📺 2023 was the year your streaming bill got more expensive.

⌚️ Apple pulls online sales of Apple Watches as US ban nears.

🛍 DTC brands doubled down on multichannel retail in 2023.

👟 Nike announces $2B cost-savings plan to drive growth and profitability.

💻 Halo effect of DTC ad spending correlated to Amazon profits.

LATEST NEWS

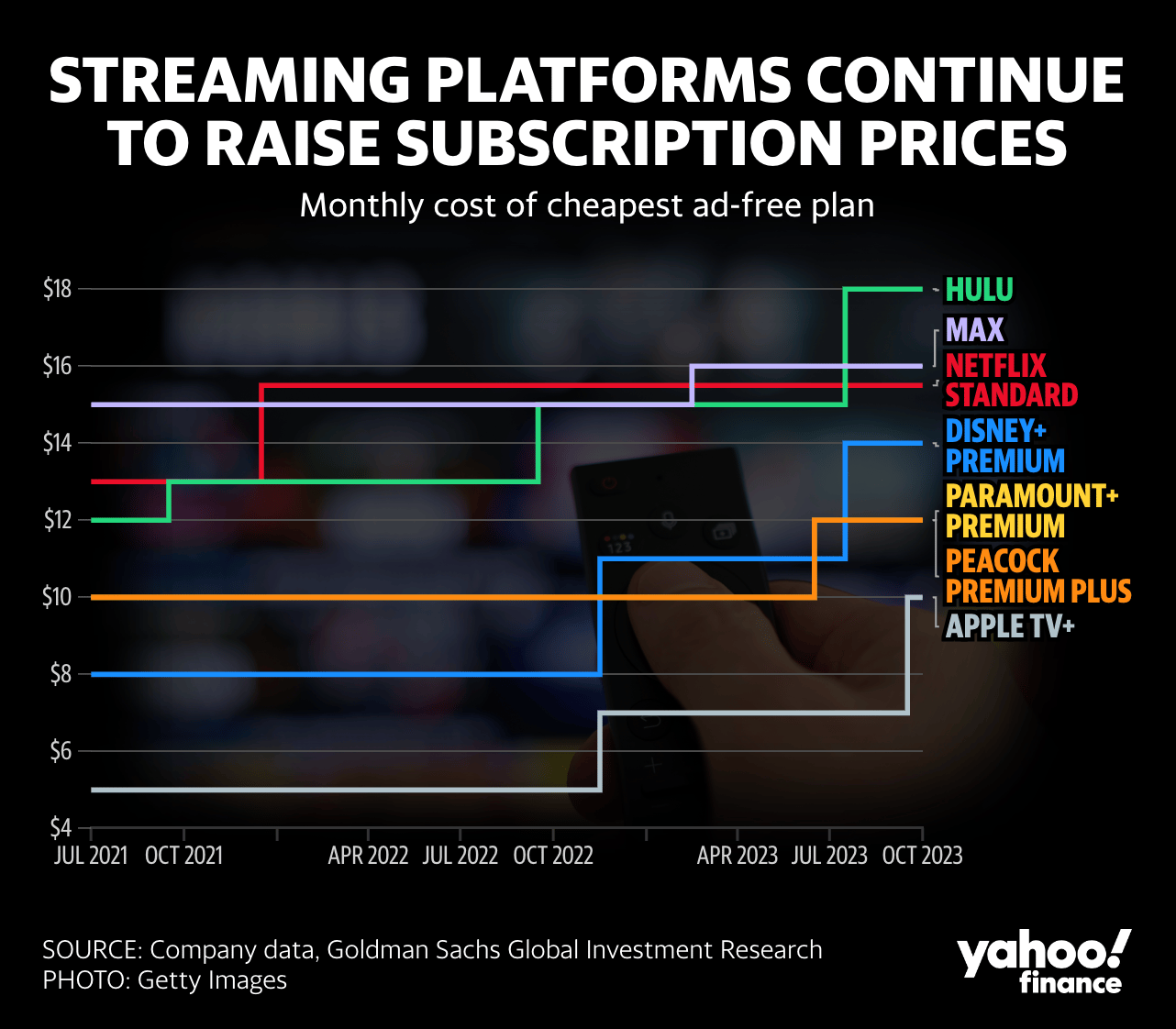

Gone are the days of cheap streaming

2023 saw dramatic increases in prices for streaming subscriptions. The cost of these services now rival cable bundles of years past — the very thing streaming set out to undo. Consumers are acting by canceling their subscription plans in response to heightened costs.

Our take: With so many streaming services in the market, players will need to offer their consumers something unique or proprietary in order for their consumers to find value in heightened prices. As a result, we will likely start to see more bundles and consolidation of platforms and content. (Welcome back to the days of cable!)

Apple has stopped selling certain watch models ahead of US ban

It is no longer possible to purchase the Apple Watch Series 9 and Apple Watch Ultra 2 from Apple’s online store. Apple removed the watches for sale due to a forthcoming import ban imposed by the US International Trade Commission (ITC). The ban is a result of a patent dispute with medical device maker Masimo. The ITC ruled that the SpO2 sensor in Apple’s smartwatches infringes upon Masimo’s patents.

Our take: The ban only applies to Apple’s own sales channels, meaning other retailers like Walmart and Best Buy shouldn’t be affected until their supply runs out. The ban also only affects US sales.

This also provides an opportunity for online resellers to hike up prices and corner the US market.

DTC brands double downed on multichannel retail in 2023

DTC companies continue to expand into brick and mortar and wholesale.

As consumers started to pull back this year, some of the biggest names to emerge from the DTC boom of the 2010s started leaning more on retail partners to drive sales and brand awareness.

It looks like the industry wide shift will continue into 2024. Allbirds CEO Joey Zwillinger mentioned in a Q3 earnings call that wholesale “remains a key channel for our future and one that provides us with the opportunity to profitably raise brand awareness.”

Our take: The second part of Zwillinger’s statement is crucial: a bigger retail presence boosts brand awareness, which is allowing some DTC brands to acquire customers online more profitably.

With the overwhelming amount of e-commerce options, is the future move for brands to go back to physical storefronts?

Nike announces $2B cost-savings plan to drive growth

Alongside Nike’s Q2 earnings, the retailer announced a cost-cutting plan aimed at generating up to $2B in cumulative savings over the next three years, according to a company press release. They plan to do this by simplifying its product portfolio, increasing automation, streamlining the organization and using scale to drive efficiencies.

Our take: Many giant retailers are feeling uncertain regarding how the economy will look in 2024 and beyond. Companies are putting plans in place now rather than later to cut back on costs and reassess overall business plans.

FEATURED CONTENT

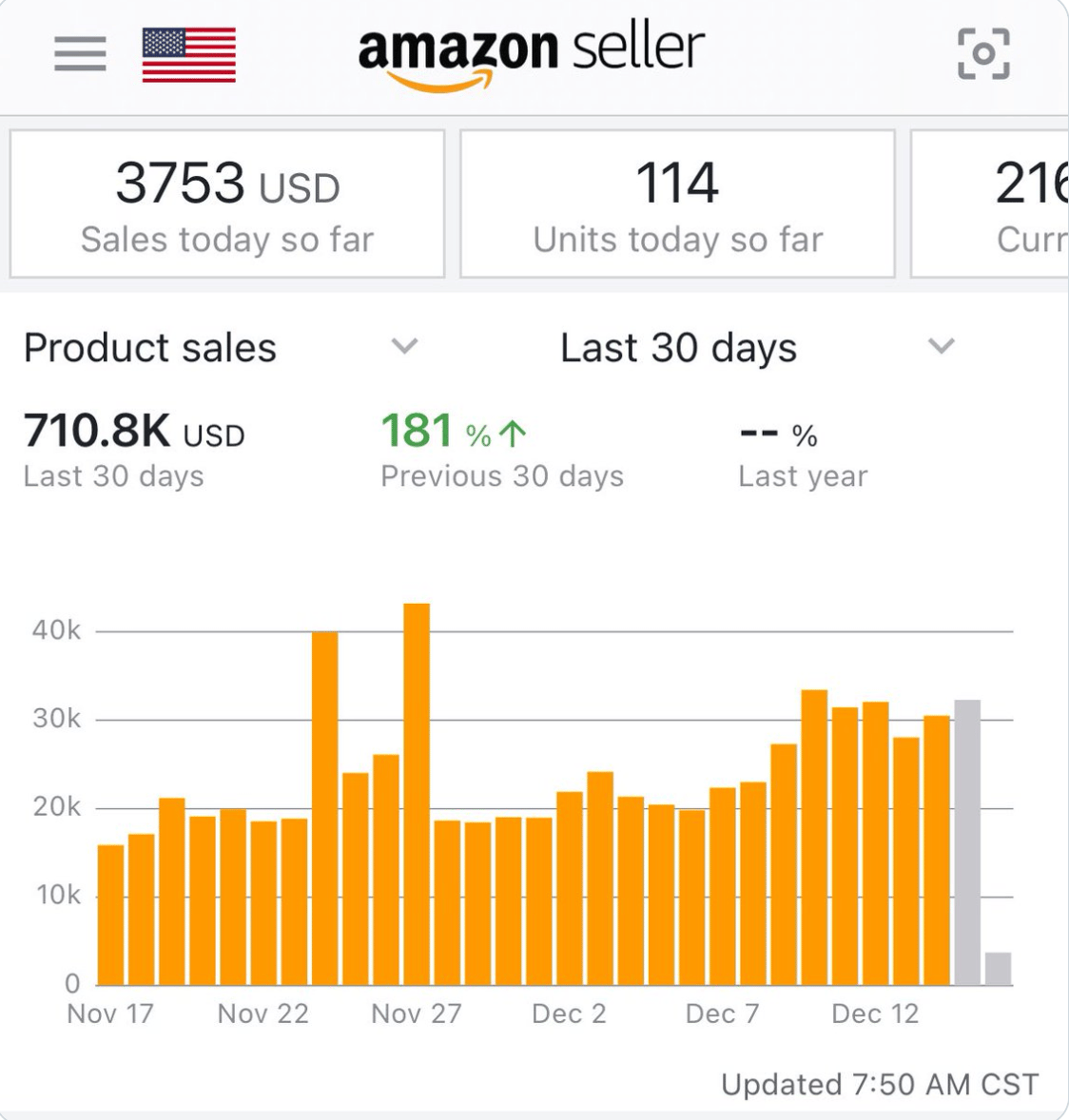

Does Amazon revenue and DTC spend have a 1:1 relationship?

Zack Stuck, founder of growth marketing agency Homestead, recently launched one of his brands on Amazon and saw $30k/day in revenue for 7 days. Stuck believes the success from this brand is coming from the “halo effect” of their DTC ad spend. The agency sees a clear correlation to Amazon revenue when they ramp up or down DTC spend.

Our take: When consumers are interested in testing out a product, they might flock to retail partners like Amazon to find and purchase the product. Stuck believes that a large portion of sales are coming from new consumers, due to a majority of sales being one unit. Additionally, Stuck and team don’t offer discounts or free shipping on their products, which also leads consumers to purchase on Amazon.

OUR SPONSOR

The DTC Dispatch is sponsored by email & SMS marketing agency, NOBLE. We build, maintain, and leverage your #1 business asset: first-party data.

As the marketing landscape changes constantly, it’s a particularly good time to invest in owned-audiences you can leverage across channels to reach the right audiences at the right time with the right message.

Interested in driving predictable revenue through owned-audiences? Just reply to this email.

🎄 Hope you have a great holiday season!

Thanks for reading this week’s edition of the DTC Dispatch.